During the assembly held on May 9 in Milan at TuttoFood international exhibition, AssoBio presented Nielsen data on the trend of organic food sales in Italian supermarkets.

During the assembly held on May 9 in Milan at TuttoFood international exhibition, AssoBio presented Nielsen data on the trend of organic food sales in Italian supermarkets.

In this sales channel, from January to April 16, 2017, total food sales (food + drinks + pet food) increased by 3.7%, up from 0.5% in 2016 (AssoBio warns that the figure may be somewhat doped by the inclusion of the Easter period).

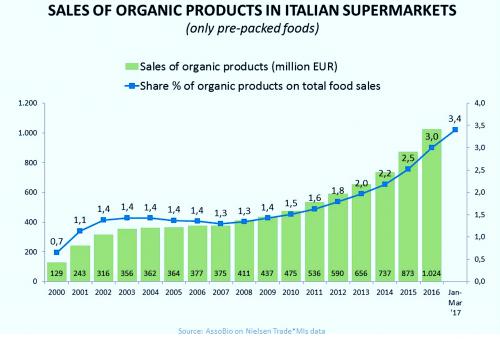

The value of sales of organic products in supermarkets, conversely, increased by 19.7%, amounting to 1.33 billion EUR in the twelve months ending March 31, 2017.

Growth was above the average in discounts (+ 31.7%) and in superettes (mini-marts, + 23.5%); supermarkets (sales of 609 million EUR, + 19.8%) and hypermarkets (sales of 409 million EUR, + 16.7%) make the lion’s share.

The share of organic food on the total food sales is 3.4 percent (it was 2 percent in 2013) and Italian consumer purchases in supermarkets have more than tripled since 2009.

Compared to the same period of the previous twelve months, overall food sales in supermarkets increased by 419 million EUR, 166 of which covered by organic products, which means that organic food contributed 40 percent to the growth of the total food markets in Italy.

The average organic product range in supermarkets grew 30%; share of organic products of the total food assortment growth is 23%: in a word, 23 out of 100 new products placed on a shelf are organic. The category is such that in 59% of supermarket promotional leaflets you can find the advertisement of some organic products (21.6% of which in the last twelve months were under promotional initiatives).

The weight of organic packaged fruit is 5.1% on its category, that of grocery 4.2%.

Among the 15 top selling products, 52.8% of whole and special pasta sold in Italy is organic, as well as 32.7% of non-dairy drinks, 30.1% of jams, 19% of pulses and grains, 14.5% of eggs, and 8.3% of flour.

75% of purchases in value are made up by 5 million households (out of a total of 20.5 million buyers, 83% of Italian households) who are habitual consumers (every week).

The penetration rate on the universe of Italian families is above the average in Northern Italy and, in a lesser extent, in central regions; in Southern Italy is below average.

Above average is the frequency of purchases in families of 3 and 4 members and between the ages of 35 to 44 and 45 to 54.

In relation to income, the penetration is practically the same in households with under average, medium and high income, while it is lower in low-income households.

In conclusion, organic growth in Italian consumption is consolidating year after year and organic is gaining a role as a determining factor in the growth of total food sales.

The main driver of growth is the widening of the range, but demand is also growing, with a strong increase in households choosing organic products (1 million more in the last year).

AssoBio focused its conference on supermarkets channel, but in Italy there is a strong specialized organic shop channel too.

Organic shops are about 1,250 all over Italy, with a stronger concentration in Northern and Central regions), about 350 are supermarket-sized with a range of around 4,500 food items. AssoBio estimates 2016 sales of 890 million EUR in the specialized channel; food service is worth around 350 million EUR (the daily use of organic products in schoolmeals is compulsory in Italy), while other channels (direct sales, farmer’s market, box schemes, on-line, small non specialized food shops) score 380 million EUR.

“The market is booming all over the world,” said Roberto Zanoni, President of AssoBio. “The consumer is increasingly aware of the overall quality of the products he buys and is less and less interested in products that, even if apparently cheap, have a heavy environmental impact. The Ministry of Environment’s official findings say that 63.9% of surface water and 31.7% of groundwater are to some extent contaminated by pesticides. All you have to do is count on official Italian Statistics data: for every Italian, conventional farming pumps more than 70 kg of insecticides, fungicidals, herbicides and chemical fertilizers in the environment. It is increasingly evident that the planet cannot sustain a production of this tenor longer. Not to mention the big issues of antibiotic abuse and the density and general conditions of mainstream breeding farms, not to mention GMOs and food additives. It is obvious that an informed consumer is looking for an alternative to this way of producing, thus becoming a protagonist of the conversion to a sustainable economy ”

“It is a contradiction that our businesses, which together with good foods produce public goods such as the protection of the environment and biodiversity, animal welfare and rural development, have to bear costs to certify that they do not pollute, while polluters pay nothing and offload the costs to the community. We do not ask for contributions, but we ask for the National Strategic Plan for the Development of the Organic System finally comes out of the drawers in which it has been carefully housed for more than a year. We started to discuss on it in EXPO Milan, it was officially approved in March 2016 by the Conference of State and Regional governments, but nothing’s has happened yet. The plan provides for the promotion of supply chain policies, research, innovation and training, institutional communication tools and regulatory simplification. The growth rate of organic agricultural surface (which is already 12% of the total national agricultural area), the growing number of farms and processing companies (+8% last year), and the increase in demand by Italian and foreign consumers show that organic food is the only credible alternative to a way of producing no longer sustainable and cannot therefore be left without basic tools to better develop and consolidate”.